If you want to know how to track your expenses using the Mint app, start with a clear plan and a simple routine.

Expense tracking works best when the steps are small and repeatable. You need accurate data, a consistent review, and basic rules for decisions.

This guide explains why tracking matters, what tools to use now, and a practical flow you can follow daily.

Why Tracking Expenses Matters for Everyday Stability

Before you dive into tools, understand the payoff from regular tracking. Visibility reduces uncertainty and prevents small leaks from compounding.

You make faster choices because you know what you can spend today. Momentum builds as you hit goals earlier, avoid overdrafts, and redirect money toward priorities instead of reacting to surprises at the end of each month.

Clarity and Control Over Cash Flow

Tracking your expenses gives you a real-time picture of inflows and outflows. You spot patterns, like subscriptions you no longer use or categories that always overrun.

With that awareness, you adjust quickly instead of rationalizing later. Control comes from swift feedback, not complicated spreadsheets, so your tracking method should emphasize speed, consistency, and decisions you’ll actually implement this week.

Lower Stress and Better Decisions

Money stress often comes from unknown balances and vague commitments. A simple tracking habit replaces guesswork with numbers you trust. You decide faster because the data narrows options to what fits your plan.

That sense of control reduces mental load and frees attention for work, family, and health, rather than running mental math every time you tap your card.

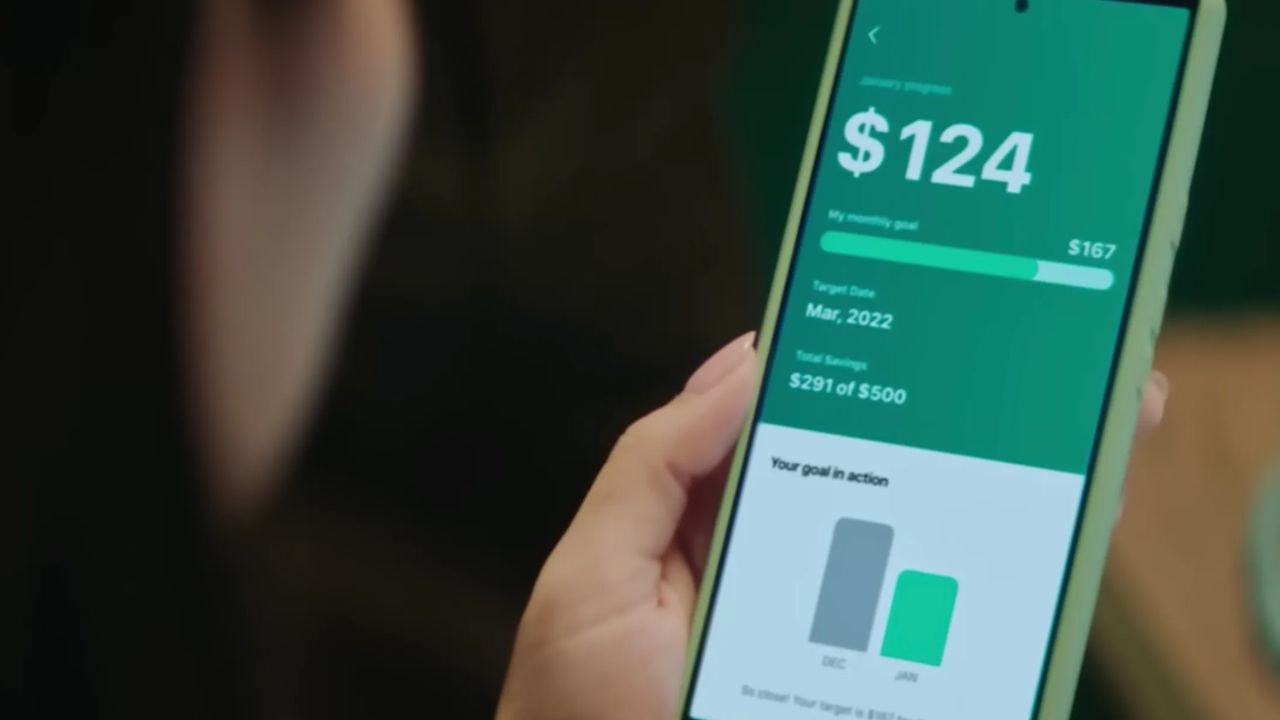

Faster Progress Toward Goals

Progress accelerates when you see exactly what moves the needle. Tracking reveals where small cuts create meaningful savings without hurting quality of life. You redirect those dollars to debt payments, emergency savings, or planned purchases.

The routine reinforces itself as wins appear, helping you stay consistent through busy seasons, travel, or unexpected expenses that would otherwise derail momentum.

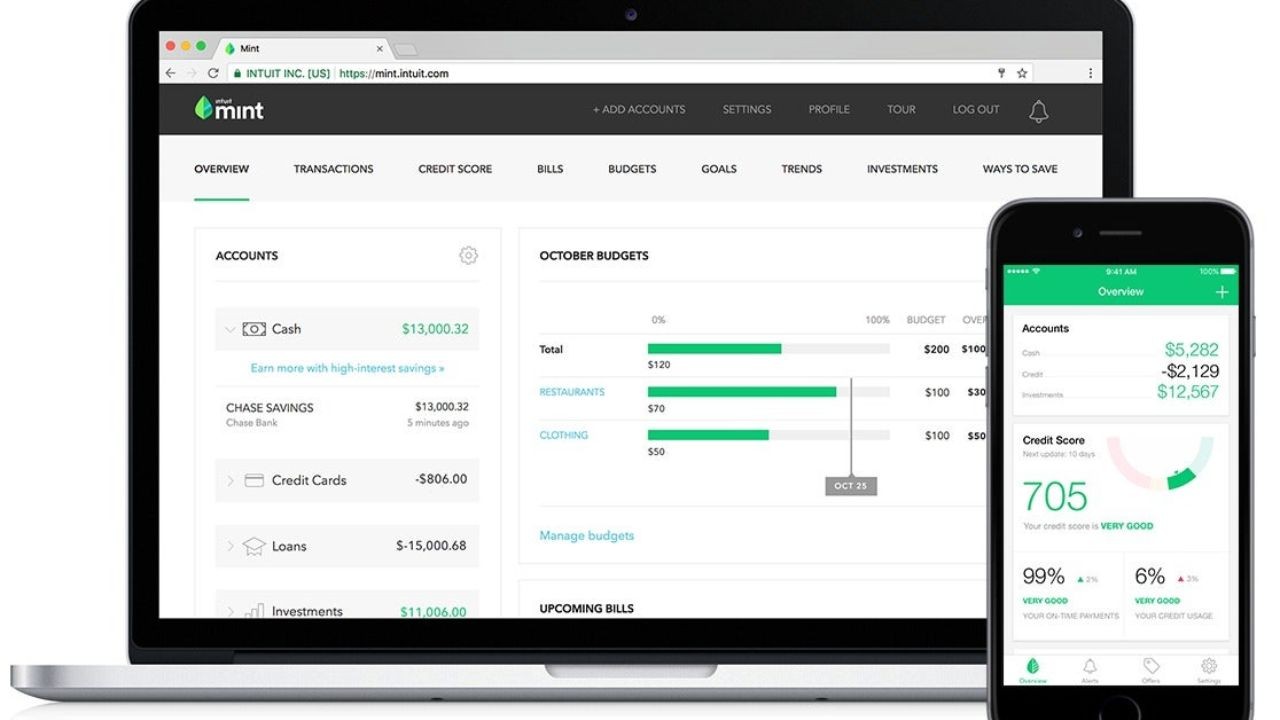

Mint App Status in 2025 and What It Means

As of 2025, Mint’s budgeting service has been retired and folded into Credit Karma. Intuit completed the transition after announcing the shutdown and guiding users to migrate.

The reimagined experience now lives in Credit Karma, which offers spending views, account connections, and net worth tracking.

Understanding this change helps you choose the right path if you previously relied on Mint for daily expense tracking.

Mint’s Retirement and Timeline

Intuit announced Mint’s closure and encouraged users to move their information to Credit Karma. The shutdown was finalized after a multi-month window, ending ongoing Mint service and support.

If you attempted to keep using Mint beyond the cutoff, you were prompted to adopt Credit Karma’s tools. The result is a new home for core functions once associated with Mint’s budgeting features.

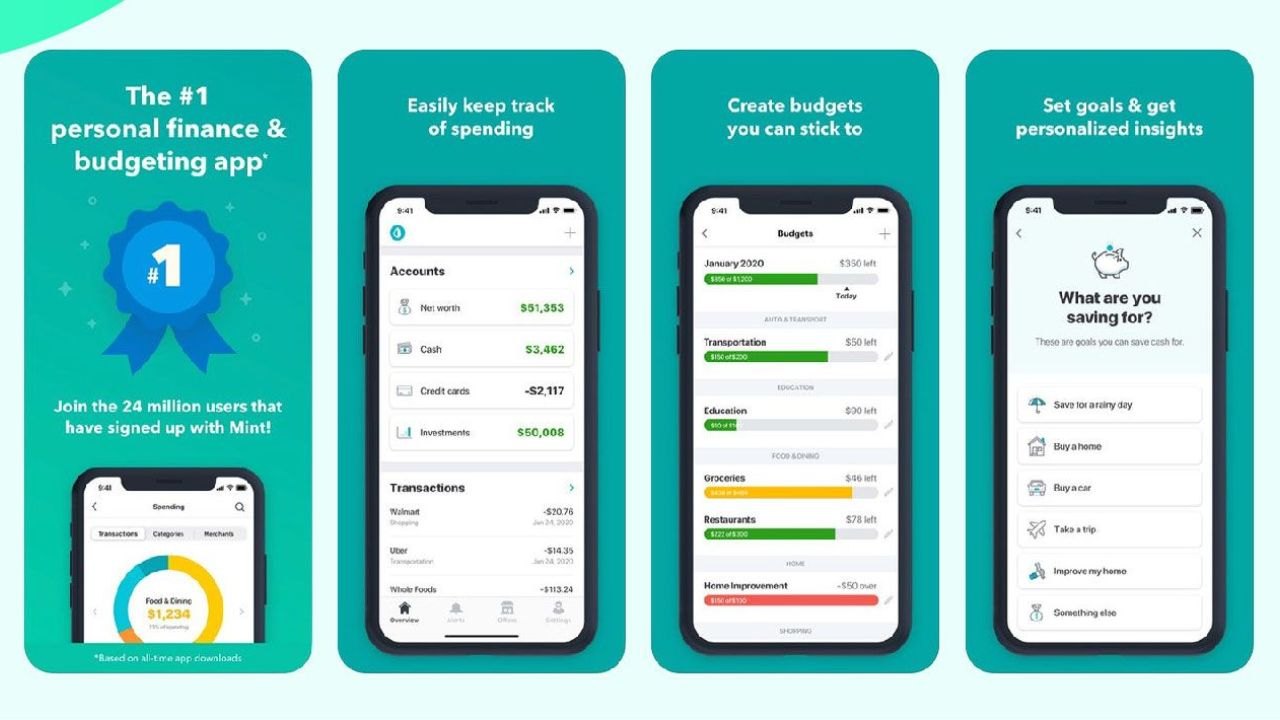

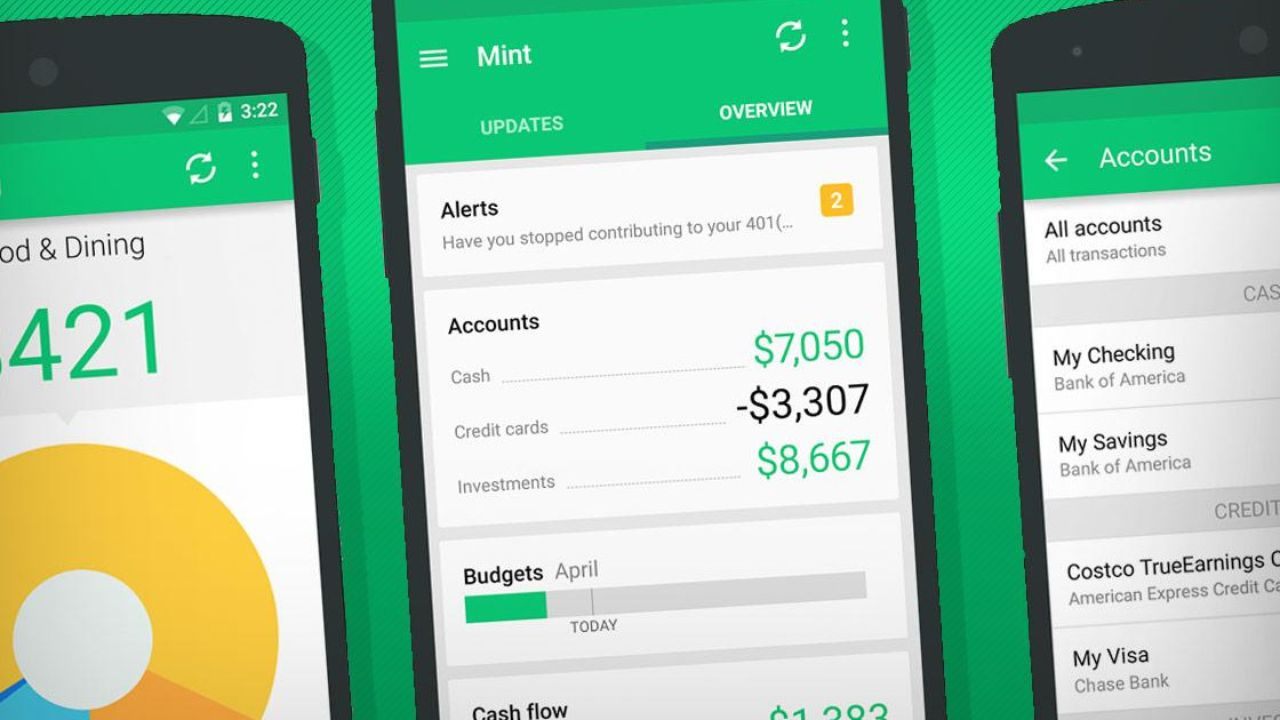

What Lives On in Credit Karma

Credit Karma now hosts many spending and account-tracking capabilities familiar to Mint users. You can connect financial institutions, review categorized transactions, view cash-flow trends, and monitor net worth in one place.

The mobile app supports alerts and insights intended to help you maintain progress. If you are new to the ecosystem, you can begin by downloading the Credit Karma app and creating a free account.

Limitations to Consider After the Transition

Credit Karma is not a one-to-one replacement for every Mint budgeting feature. Some users report fewer granular budgeting controls and coverage gaps for certain institutions.

If you need strict category caps or manual debt entry, you may need supplementary methods. Still, for many people, Credit Karma provides an accessible path to maintain daily expense visibility without rebuilding everything from scratch.

Core Features to Track Spending Effectively

The essentials have not changed, even with the platform shift. You need reliable account aggregation, clean categorization, and simple views that highlight what to do next.

Prioritize features that reduce manual effort and surface actionable insights. When your tool shows you where money is going and what changed this week, you can adjust quickly and keep your plan realistic.

Account Aggregation and Automatic Categorization

Connect your checking, savings, credit cards, and loans so transactions flow into one dashboard. Automatic categorization saves time and reveals spending groups you can monitor.

Review new transactions daily and correct any mislabels to train for better results over time. With accurate categories, you can compare weeks cleanly and decide whether a spike is a one-off or a trend worth addressing.

Budgets, Alerts, and Cash-Flow Views

Budgets and alerts help you react before overspending snowballs. Set simple targets that match your current behavior, then nudge them tighter as you improve.

Cash-flow charts show whether your average week supports your goals or hides shortfalls.

Use those views to schedule adjustments, like moving bill due dates, consolidating subscriptions, or planning high-spend periods with stronger buffers.

Net Worth and Transaction Review Workflow

A single net worth view ties your spending choices to long-term progress. Pair that with a fast transaction review habit so nothing slips through.

Open your app once a day, clear yesterday’s entries, and note any category drifting upward.

This short loop prevents backlog, keeps categories accurate, and makes monthly summaries feel straightforward rather than exhausting at statement time.

Where and How to Download the App Today

Download the app from your device’s official store and create a free account. Sign-up uses standard identity checks similar to other financial apps.

Once inside, you can enable biometric login, set up notifications, and review the initial dashboard.

The app’s onboarding will prompt you to connect accounts, which unlocks spending insights and transaction views designed to replace Mint’s defunct service.

Set Up, Sync, and Secure Your Data

Start by connecting your primary bank, everyday credit card, and any bill-pay account. Confirm each connection updates correctly and check the first wave of categories for accuracy.

Enable security features, including two-factor authentication and device biometrics. Schedule a short daily check to clear new transactions, and a weekly review to scan trends, so your data stays clean and useful for decisions.

Step-by-Step: How to Track Your Expenses Using the Mint App—The Modern Way

Although Mint no longer operates, you can mirror its method within Credit Karma today. The process is the same: connect accounts, verify categories, and review a simple set of views.

Keep the routine short and consistent so it survives busy days. Your goal is to turn insights into small adjustments that accumulate into better cash flow and earlier financial wins.

Connect Accounts and Verify Categories

Start with your main checking account, everyday card, and any account holding recurring bills. Let transactions import, then review the latest entries one by one. Fix miscategorized items immediately so future imports learn from your corrections.

Aim for a zero-backlog policy, because accurate categories reduce confusion later and help you trust weekly cash-flow summaries without extra reconciliation work.

Review Recurring Charges and Adjustments

Identify subscriptions, memberships, and annual renewals as soon as they appear. Decide whether each charge still matches your current priorities and usage. If not, cancel or downgrade before the next billing cycle to avoid waste.

For necessary services, set calendar reminders for renewal dates, and consider annual versus monthly pricing to align expenses with cash flow while minimizing unwanted surprises.

Schedule Weekly Reviews and Monthly Close

Hold a short weekly review to compare category trends and adjust targets. Use that review to plan upcoming high-spend events, like travel or gifts, and set a small buffer.

At the month’s end, run a quick close by capturing highlights, misses, and one change to test next month. This rhythm replaces financial anxiety with a calm, repeatable system that compounds results.

Benefits of Starting Your Tracking Habit Now

Starting today prevents drift and lets you collect useful data before year-end. Early tracking exposes easy wins and creates believable budgets.

You avoid reactive decisions driven by guesswork because your numbers guide each adjustment.

Over a few weeks, the habit becomes automatic, and the reduced stress alone often feels like a raise, even before larger optimizations begin showing up in your balances.

Motivation, Momentum, and Measurable Wins

Motivation grows when you see proof that changes work. Category declines, subscription cancellations, and steadier cash flow build confidence. You begin planning purchases ahead of time rather than reversing mistakes later.

That shift protects your energy and time, turning money management into a short daily maintenance task instead of an occasional crisis that interrupts everything else on your calendar.

Protecting Long-Term Goals With Short-Term Feedback

Tracking links today’s choices to tomorrow’s goals. When cash flow aligns with priorities, you can fund emergencies, investments, or vacations without stress. Short feedback cycles make course corrections painless because problems stay small.

The habit doesn’t require perfection, only persistence, and a structure that survives busy seasons. Consistency outperforms complexity, especially when work and family demands fluctuate.

Conclusion

To track your expenses using the Mint app in 2025, adopt Credit Karma as Mint’s successor and keep your routine short. Connect essential accounts, verify categories daily, and review trends weekly.

Let simple views drive small decisions that compound into measurable progress. With a lean process and consistent check-ins, you’ll replace uncertainty with clarity, reduce stress, and keep money moving toward the outcomes that matter most.