Across the UK market, applying for a Lloyds Bank Credit Card online follows a clear two-step flow that avoids unnecessary credit score hits until the final submission.

Early screening uses a soft check to show realistic options and an estimated limit, while the full form completes the UK credit card application with a hard search.

Because card features, fees, and promotional windows change, verification on official pages before submitting remains essential. Section 75 purchase protection and broad Mastercard acceptance round out everyday usability for qualified applicants.

Who Can Apply and What to Prepare

Applicants must meet the base eligibility criteria: UK resident, aged 18 or over, with a regular annual income and no recent bankruptcies, IVAs, or CCJs.

Lloyds also specifies that applicants should not be unemployed or a student, and should not have been declined for a Lloyds card in the previous 30 days.

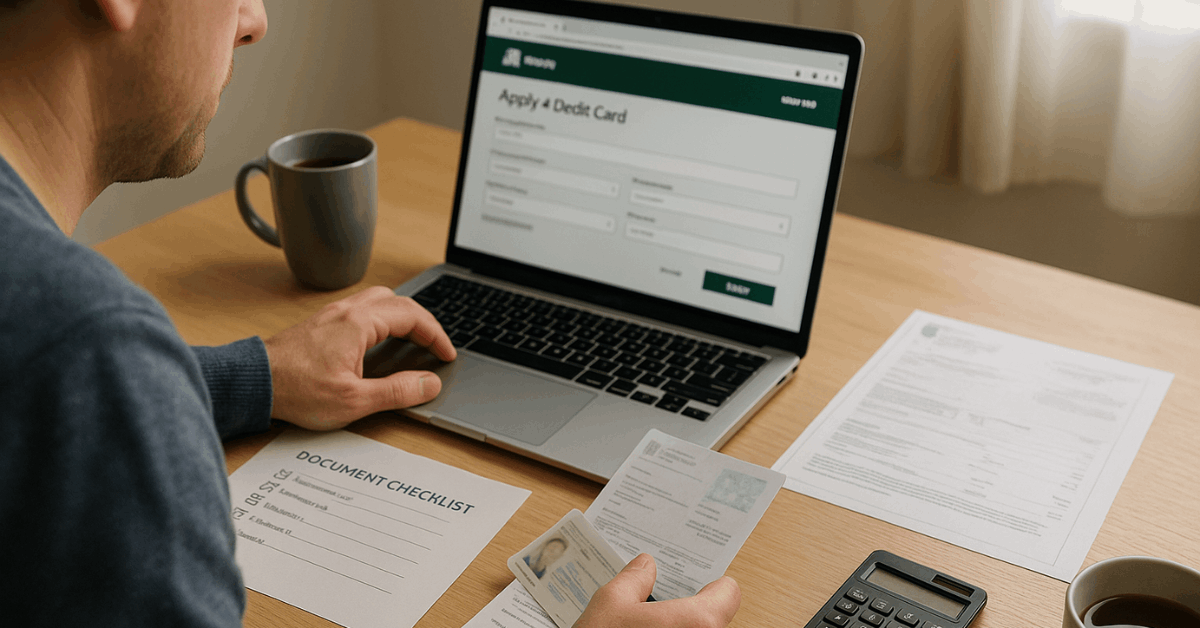

Preparation includes at least three years of UK address history, a contactable email and phone number, and the main bank account number and sort code. These inputs allow quick identity checks, affordability assessment, and automated status updates during processing.

The Two-Step Online Application Flow

Soft-search screening sits in front of the full application, so early checks do not harm credit files. A clear handoff then collects the remaining details and performs a full credit search, which can influence your score.

Expect on-screen guidance and decision updates as you progress, with a security timeout that clears inactive forms for privacy.

Step 1: Check eligibility with Lloyds One Check

Using the built-in eligibility checker displays cards you’re likely to be approved for and shows an estimated credit limit up front, all with no credit score impact.

A single short form powers this view, helping applicants focus on practical options instead of applying blindly. This stage refines expectations and reduces unnecessary hard searches across multiple products.

Step 2: Select a card and complete the full form

After reviewing likely matches, proceed to the secure application and follow the on-screen instructions. A full credit search is completed at submission and will be recorded on the credit file.

The journey confirms standard details, including address history, contact info, and main bank account, then captures employment and financial commitments to support affordability checks.

Lloyds notes that applicants may see a successful outcome partway through the application, with the remaining steps handling setup and account documentation.

What Lenders Assess and How Decisions are Made

Lenders weigh several signals beyond income, including credit score, current borrowing, payment history, time at address, and employment stability.

Past account conduct and realistic affordability shape the offered limit and rate, even when an application is accepted. Soft checks preview eligibility without affecting scores, while hard checks at submission can have a credit score impact depending on the rest of the file.

Maintaining accurate information and avoiding concurrent applications helps preserve approval odds and pricing.

Requesting a Balance Transfer During the Application

Many applicants add a balance transfer when they apply, using account details from another card to transfer existing balances.

Transfers are generally accepted from most credit cards and some store cards that display Mastercard®, American Express®, or Visa® logos; transfers from loans, bank accounts, or other Lloyds Bank credit cards are excluded.

Promotional 0% periods usually apply only to transfers made within a defined offer window after account opening, and a transfer fee often applies. Careful timing and scheduled repayments help clear the debt within the offer window and avoid revert-rate interest.

Typical Features and Everyday Protections

Card purchases between £100 and £30,000 can qualify for Section 75 protection, which makes the lender jointly liable with the retailer if goods fail to arrive or are mis-sold.

Chargeback options exist outside Section 75, particularly for card-scheme disputes where the amount or merchant type falls outside statutory coverage.

Everyday travel usability benefits from Mastercard acceptance worldwide, though spending abroad may include a non-sterling transaction fee depending on the product. Checking a card’s summary box before applying confirms exact protections, fees, and any cash-transaction exclusions.

Costs and Fees

Remember these fees and costs when you apply to avoid surprises:

| Cost area | Typical treatment at Lloyds | What to check before applying |

| Annual fee | Many consumer cards carry £0 annual fee; some premium products charge a monthly fee. | Confirm if any monthly or annual fee applies to the exact card chosen. |

| Foreign spending | A non-sterling transaction fee around 2.95% is common on many products. | Check if your chosen card waives or charges this fee for purchases abroad. |

| Balance transfers | Promotional balance transfer credit card offers often include 0% interest for a set window, plus a transfer fee. | Verify the 0% window length and fee percentage, and when transfers must be completed. |

| Late or missed payments | A late payment fee may apply and promotional rates can be withdrawn. | Set up Direct Debit and pay on time to retain offers and protect your score. |

| Representative APR | Depends on your circumstances and the selected product’s pricing. | Use the eligibility view for an estimated limit; confirm APR in the summary box. |

After Submitting: What Happens Next

Applicants generally receive status feedback during the process, then follow standard onboarding steps if approved. Cards and PINs typically arrive by post, and details appear in the mobile app shortly after dispatch for early wallet provisioning.

Activation may be required depending on the card; instructions in the pack or on the sticker guide the final step. Where a decline occurs, guidance from Lloyds explains common reasons and next steps for improving eligibility before reapplying.

If Approved

Account setup information and limits are confirmed in the welcome materials and app. Digital wallet setup often precedes the physical card’s arrival once details populate in-app, enabling quicker access to card numbers for online purchases.

Managing statements, alerts, and Direct Debit inside online banking helps avoid missed payments and protects any 0% or introductory 0% purchase period.

If Declined

Unsuccessful outcomes can stem from thin credit history, high existing borrowing, unstable income, or recent hard searches.

Credit-education pages outline practical steps, including reducing utilization, correcting errors on credit files, and waiting before making a fresh application.

Eligibility tools remain useful for gauging readiness without another hard search while you address identified gaps.

Responsible Setup: Quick Wins that Protect Offers

Setting a Direct Debit to pay at least the statement minimum prevents accidental late fees and safeguards promotional rates. Paying more than the minimum every month reduces interest exposure faster and shortens payoff time after promotions end.

When carrying promotional balances, avoid mixing large new purchases to preserve any purchase grace period rules and simplify repayment tracking.

For foreign travel, confirm the non-sterling fee on your chosen product and opt to pay in local currency to avoid dynamic conversion markups by merchants.

Documents and Details to Have Ready

A smooth submission depends on accurate data and a few specific items. Ensure the last three years of UK addresses are available, including move-in dates for each address.

Keep employment details, annual income, and monthly commitments to hand for affordability assessment. If planning a transfer, have the other card’s issuer, number, and current balance ready so the request can be queued at account opening.

Why the Official Website Route is Often the Fastest Path

Centralized guidance on the Lloyds site avoids outdated third-party terms and shows a real-time picture of offers.

The One Check flow takes minutes, surfaces estimated limits, and narrows down choices without harming credit files, which keeps options open if circumstances change.

A single, secure application then completes the UK credit card application and provides progress updates, with a privacy-minded timeout that clears inactive sessions. Combining these steps keeps the process efficient and largely self-serve.

Important Reminders on Protections and Fees

Under the Consumer Credit Act, Section 75 protection may apply to qualifying credit card purchases between £100 and £30,000, making the lender jointly liable with the merchant if the contract fails.

Chargeback provides an additional scheme-level dispute route when Section 75 doesn’t apply, but evidence standards differ by card network.

Foreign usage often incurs a non-sterling fee unless the specific product waives it; reading the summary box remains the definitive way to confirm card-level charges. Finally, missing a payment can forfeit promotional rates and negatively affect credit scores, so automation and early alerts are prudent.

Conclusion

Applying for a Lloyds Bank Credit Card through the official website is intentionally straightforward: pre-screen with Lloyds One Check, then complete the full form only when the right fit appears.

Eligibility criteria focus on residency, age, income, and clean insolvency history, and the final decision weighs credit data alongside employment and address stability.

Balance transfer options, global Mastercard acceptance, and statutory Section 75 protection make the cards practical daily tools when used responsibly.