Across UK-focused banking alternatives, the Suits Me Card delivers speedy onboarding, instant account credentials, and broad ID flexibility.

Applicants complete a short online form, pass standard anti-money-laundering checks, and gain instant account access to begin receiving money and paying bills immediately.

Because Suits Me runs a no credit check bank account model, approval moves faster than traditional banks and remains accessible for newcomers or those rebuilding finances.

What Is the Suits Me Card?

In practical terms, Suits Me provides an e-money current account with a contactless Mastercard debit card, online banking, and a mobile app.

Cards are issued by IDT Financial Services Limited, a regulated bank licensed by the Gibraltar Financial Services Commission and permitted by the UK Financial Conduct Authority to issue e-money; funds are not covered by the Gibraltar Deposit Guarantee Scheme because this is an e-money product rather than a deposit account.

Corporate disclosures also list the registered office in Gibraltar for the card issuer and the UK registered address for Suits Me Limited in Knutsford, Cheshire.

Why Speed is A Standout

Expect rapid setup because eligibility focuses on identity and basic residency, not credit history or income.

The platform emphasises instant account access to sort code and account number after approval, allowing immediate transfers and bill setup even before the plastic arrives.

Fastest Way to Order and Get Approved

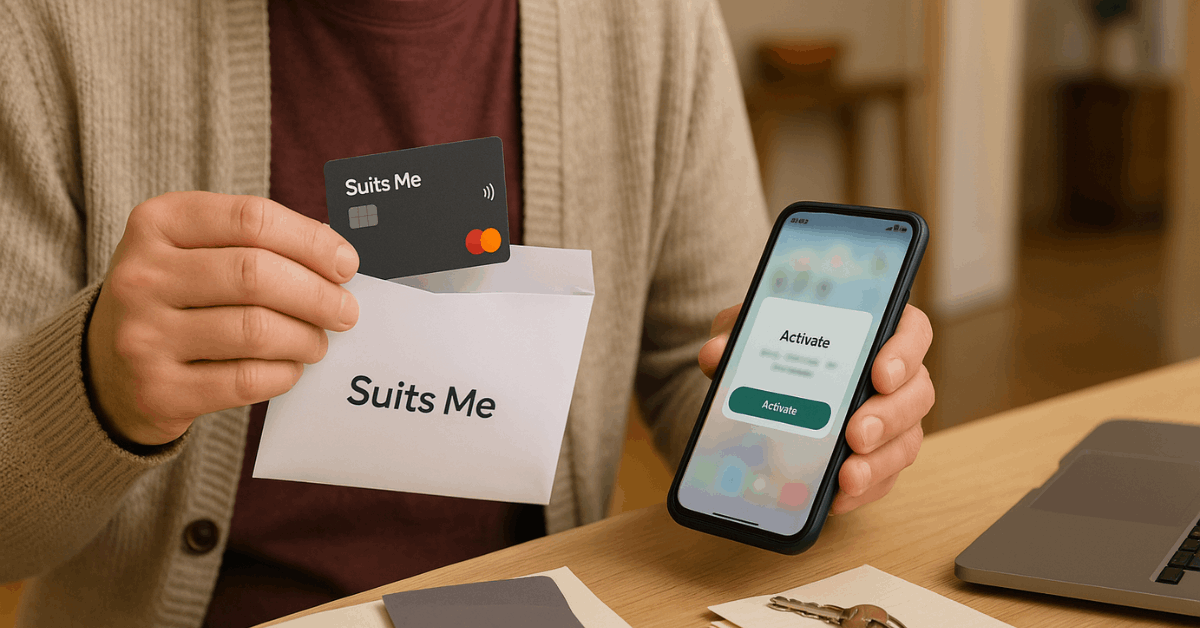

Clear steps and a minimal document list compress onboarding into minutes, then the physical card follows by post.

Treat the plan picker as part of the application, because the chosen tier sets monthly cost and included benefits.

Applicants meeting the age and UK-address criteria generally receive a decision quickly, with rare cases requiring manual review when photo ID isn’t available. Activation is completed in-app or by phone using the provided instructions.

Key Speed Factors

Short setup remains realistic when a few conditions are in place. Prioritise these to keep the process under ten minutes.

- Online form completion typically opens the account within about ten minutes once submitted.

- Identity verification accepts passports, driving licences, national ID cards, and ARC cards, alongside a selfie.

- No credit checks reduce friction and broaden eligibility for thin files or past credit issues.

- Credentials arrive immediately, enabling transfers and payments in the app while the card ships.

- The contactless Mastercard debit card typically reaches UK addresses in three to five working days.

Step-By-Step Application

Follow a concise five-step flow to minimise delays.

- Visit suitsmecard.com/apply and select Essential, Premium, or Premium Plus.

- Enter personal details, including a UK delivery address for the card.

- Upload one accepted photo ID and a clear selfie for verification.

- Receive your sort code and account number; log in to the Suits Me app to activate features.

- Watch for the card to arrive by post, then complete activation per the enclosed instructions.

Eligibility and ID Checklist

Applicants must be aged 18 or over and live in the UK, since the card must be posted to a local address; proof of address isn’t always required, which simplifies onboarding for house shares and recent arrivals.

Valid identity can include a UK or foreign passport, UK driving licence, national identity card, or an ARC card for asylum seekers.

Where mainstream photo ID isn’t available, Suits Me highlights alternative ID routes and a selfie capture, with applications still subject to UK AML rules.

Plan Choices and Suits Me fees

Essential is pay-as-you-go, Premium adds a modest monthly fee for lower per-transaction charges, and Premium Plus increases the monthly fee while bundling more included usage, such as free domestic ATM withdrawals.

At-a-glance pricing (confirm live rates before applying):

| Plan | Monthly fee | UK ATM withdrawals | Notes |

| Essential | £0.00 | £1.50 each | Pay-as-you-go; higher per-use charges. |

| Premium | £4.97 | £1.25 each | Lower transaction fees than Essential. |

| Premium Plus | £9.97 | 4 free per month, then £1.25 | Best for heavier monthly usage. |

Card Delivery and Account Timeline

Most approved accounts open within roughly ten minutes, granting instant online access, while physical cards arrive in three to five working days.

If manual checks are needed, common when applying without a photo ID, approval can extend to twenty-four hours, and in rare cases up to seven days.

Confirmation emails with account details typically follow within twenty-four hours when not delivered immediately; checking spam folders helps avoid missed messages.

Using the Account: Features and App

After activation, expect standard payment features such as Faster Payments, Direct Debits, and standing orders, managed in the Suits Me app or online banking.

Cashback and merchant discounts are available for eligible spending, and multilingual support is available in more than a dozen languages.

Card controls and security tips are provided in the help centre, and telephone activation remains available for those preferring voice support.

ATM, International, and POS Costs to Know

Domestic cash withdrawals cost £1.50 on Essential and £1.25 on Premium and Premium Plus, with Premium Plus including four free UK ATM withdrawals monthly.

International ATM withdrawals are listed at £2.50, with a separate foreign-exchange fee of 2.57% applied to international cash and purchase transactions.

POS transactions abroad also carry a £1.97 fee, so frequent travellers should compare total costs against travel-oriented accounts.

Alternatives for Different Use Cases

For occasional domestic spending with minimal monthly commitments, Pockit’s entry tier lists a £0 or low monthly price on some offers, with UK ATM fees commonly around £1.49–£1.99 and a 4% FX fee for foreign use.

Revolut Standard has no monthly fee and allows free ATM withdrawals up to £200 or five withdrawals per month, after which a 2% fee applies.

Those spending frequently in foreign currencies often prioritise specialist travel accounts, while applicants seeking UK alternative banking without credit checks often weigh Suits Me against prepaid or e-money peers. Always confirm live fee tables on provider pages before deciding.

Key Fit: Who Benefits Most

Applicants needing a quick, no-credit-check bank account for wages, benefits, or side-hustle income see clear advantages in Suits Me’s fast decisions and instant account access.

Those using UK cash machines frequently often prefer Premium Plus because of the bundled free withdrawals and lower ongoing fees on common transactions.

Regular international spenders might compare total costs against travel-oriented accounts to avoid foreign transaction charges and FX margins. Treat plan choice as a lever: heavier domestic use generally favours the higher tier, whereas occasional use aligns with Essential’s pay-as-you-go structure.

Quick Decision Guide

Matching usage to the right plan reduces avoidable fees and keeps the account working as intended.

- Choose Essential for light, occasional use where monthly fees aren’t justified.

- Choose Premium when running routine bills and transfers with predictable, lower per-transaction pricing.

- Choose Premium Plus if you withdraw cash regularly and send multiple payments monthly.

- Consider travel-oriented alternatives for frequent foreign transactions or large monthly FX exposure.

Compliance Snapshot

Treat Suits Me as an e-money current account, not a credit facility; there’s no overdraft, interest rate, or credit building.

Card issuance and safeguarding follow the issuer’s e-money permissions, while the product remains outside deposit-guarantee coverage. Application speed and identity flexibility remain subject to AML and regulatory checks noted in official help articles.

How to Maximise a Fast Approval

Providing a valid photo ID and taking a clear selfie helps avoid manual review delays, especially for applicants without a passport or UK licence.

Ensuring the UK delivery address is correct prevents card-mail issues, while enabling app notifications helps catch instant emails with account credentials.

Asylum seekers can apply using an ARC card plus a selfie, reflecting Suits Me’s inclusive ID list.

Contacts, Security, and Company Details

Customer support operates Monday to Friday, 9:00 to 20:00 UK time, on 03330 151 858, with a 24/7 option for lost or stolen card reporting via the same number using the appropriate menu.

Corporate pages list Suits Me Limited’s registered office at The Old Shippon, Moseley Hall Farm, Chelford Road, Knutsford, WA16 8RB, while the card issuer’s registered office is 57–63 Line Wall Road, Gibraltar.

Security guidance emphasises never sharing PINs or online credentials, and contacting Suits Me customer service immediately if suspicious activity appears.

Conclusion

Across everyday UK needs, Suits Me delivers quick, no-credit-check access plus instant credentials for incoming pay and bills. Treat it as an e-money current account, confirm live fees, and pick the tier that matches monthly usage.

Frequent domestic cash withdrawals typically favor Premium Plus, while occasional spenders keep costs low on Essential’s pay-as-you-go structure. Prepare acceptable photo ID and a clear selfie to speed approval, then enable app alerts for activation and security updates.

Regular foreign transactions warrant comparing total FX and POS charges against travel-oriented accounts before committing.

Disclaimer

This guide provides general information only and isn’t financial advice. Pricing, fees, features, and eligibility criteria can change; confirm current terms on Suits Me’s website and in the help centre before applying.